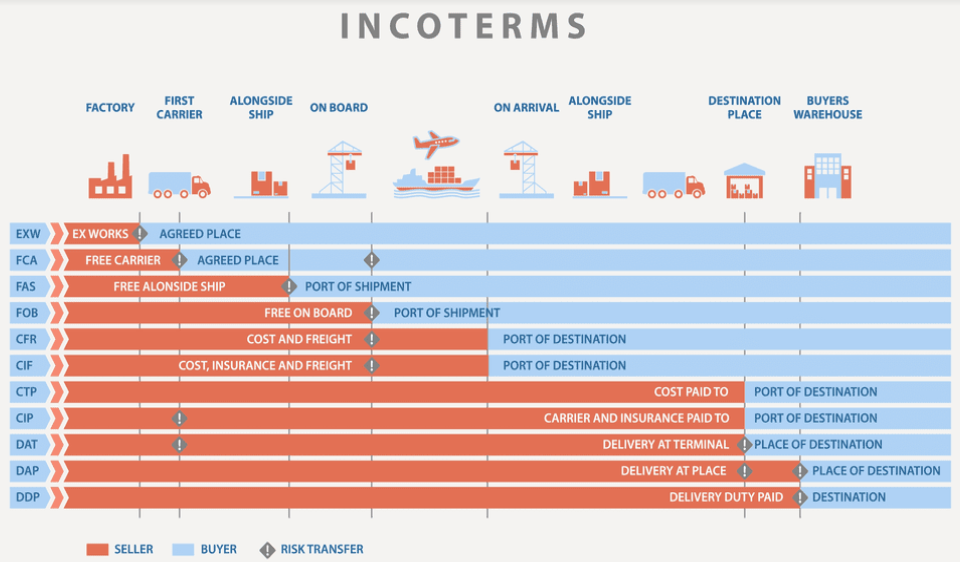

International Trade Conditions and Disclosures (INCOTERMS)

- EXW (Ex Works):

The first of the Incoterms® rules is unique for several reasons. It’s the only rule in the E-rules group since it’s the only rule that makes the delivery of goods possible at their own point of origin. It’s also the rule that imposes minimal obligations on the selling party but focuses mainly on regulating the obligations of the buying party.

The Ex Works rule enables the selling party to fulfill its obligations without loading the goods on the initial transport that’s taken care of by the buying party. Although, a special option marked as “LOADED”, following the EXW term, can be drafted which entails that the selling company agrees to load the goods onto the initial transport vehicle.

The selling party’s obligations include packaging and labeling the goods and providing the buying party with receipt proof of the sale.

To benefit from the EXW rule, we advise buying parties to ensure loading is included when hiring a transport vehicle in order to avoid unnecessary incidents.

EXW is suitable for shorter distances between the initial and the final destination where the goods are handled in smaller loads or parcel shipments.

2. FCA (Free Carrier):

Free Carrier – FCA is the first of the three F Incoterms® rules and the only rule in this group that refers to multimodal transport.

If the selling and the buying parties agree to settle their international sales contract in accordance with this rule, the selling party takes responsibility for delivering the goods up to the point where the main transport stage of the logistic chain begins.

Unlike many of the Incoterms® rules, the FCA rule provides greater flexibility when deciding what to appoint as the place of delivery. The seller and the buyer parties can choose between the seller’s point of origin (its premises that can include warehouses, distribution platforms, factories, depots, etc.) or a named place where the goods will be made available to commence on their main journey (a sea or inland port, an air cargo terminal, a railway container terminal, a freight forwarder warehouse, etc.)

According to this rule, it’s the buying party’s obligation to hire a carrier for the main transport of the goods and bear its costs and risks.

With this rule, it’s also clear that the selling party is the one who should clear the goods for export and cover the costs for export certification and documentation.

3. FAS (Free Alongside Ship)

The second rule in the F-rules group is the FAS rule – Free Alongside Ship – the first Incoterms® rule designed to regulate international maritime trade transactions.

This rule can be used whenever the buying party hires a vessel to conduct the delivery of the goods during the main transport stage of the logistics chain. Therefore, the FAS rule can only be used for transport that occurs at sea or inland waterways.

The selling party’s responsibilities here extend to providing island transport of the goods up to the dock/quay where the buyer’s hired vessel will be accepting the goods, hence, its name (alongside ship). The seller should deliver the goods on the agreed date and time and supply the buying party with the related maritime/port documents that prove the delivery.

At the buyer’s discretion, the bill of lading, which is a receipt documenting the goods that will be on board to be shipped, can be obtained with the selling party’s assistance.

In short, the selling party’s obligations include packing, labeling, obtaining export clearance, loading, transporting the goods to the corresponding cargo quay or terminal, and unloading.

4. FOB (Free on Board)

Extending the FAS rule, the FOB Incoterms® rule (Free on Board) is the third and last of the F rules.

It’s another rule that regulates maritime transport (sea and inland waterways) and one more obligation for the selling party than the FAS rule and that’s loading the vessel hired by the buying party with the goods to be delivered.

By doing this, the selling party obtains the bill of lading themselves and is, therefore, required to provide the buying company with it, even though the shipping transport is hired by the latter.

This documentation is obtained at the request of the buying party and the selling party is required to assist them in their request. However, the costs and risks for this obligation are still borne by the buying party.

So, even though the buyer pays for loading and stowing of the goods to their booked ship, the risks at this stage are still carried by the selling party.

The FOB rule is frequently used in bulk shipments and is often accompanied by extensions such as “STOWED” or “STOWED and TRIMMED” which are to denote that the goods have been properly loaded onboard the ship, leveled off, and secured.

5. CFR (Cost and Freight)

The C group of the Incoterms® rules observe the same practice as the E and F rules in regard to the transfer of risks and the delivery of the goods. They all happen in the country of origin.

What’s different is the obligations that the selling party has when it comes to the main transport – according to the C rules, the selling party bears the costs for the main transport of the goods.

The first of these rules – the CFR (Cost and Freight) rule – provides directions within the international sales contract when the main transport of the goods is conducted via maritime means.

The seller’s responsibilities include packing and labeling, loading the goods for inland transport, and unloading them onto a freight vessel that has been booked by this party in advance.

The buying party obligations resume when the goods arrive at the port designated by them. So, they are required to unload the goods from the vessel, pay the necessary port charges, clear them at import customs, transport the goods, and unload them at the final destination.

It is also possible to have the selling party agree to pay for the unloading of the goods at the port of destination. This needs to be explicitly expressed in the sales contract with the CFR extension “LANDED”.

6. CIF (Cost, Insurance, and Freight)

Practically imposing the same obligations as the CFR rule, the CIF Incoterms® rule (Cost, Insurance, and Freight) has one more requirement for the selling party. That makes it the first rule on this list that requires the selling party to obtain insurance for the transport of the goods during the main stage of the logistics chain.

Just like the CFR rule, this rule is appropriate only for maritime transporting of goods (sea and inland waterways). The other conditions are the same as well – the CIF rule obligates the selling party to take care of the freight costs for the buying party and ensure the goods are transported to the final port of destination.

There, the goods can be unloaded from the shipping vessel if both parties agree on it in their international sales contract by extending the CIF rule with the term “LANDED”.

With this type of regulation, the seller has to make the bill of lading readily available to the buyer as this document is necessary for the latter when intercepting the goods at the destination port.

The bill of lading should also be negotiable, meaning it has to provide the ability for the buyer to sell the goods even before they reach the final port (while still in transit).

7. CPT (Carriage Paid to)

With the CPT rule (Carriage Paid to), both the selling and the buying party can agree that the place of destination of the goods can be any place on the route from the seller’s premises to the buyer’s premises.

Just like the CIF and CFR rules, according to the CPT rule, the entire transport up to the point of the destination of the goods designated by the buying party is a responsibility of the selling party which bears all the costs connected to this phase. Similarly, the transfer-of-risks stage takes the same approach

But, unlike the CIF and CFR rules which regulate only maritime traffic, all modes of transport can be used when hiring a carriage following the CPT rule (rail, road, air, and sea). Also, unlike the previous C-rules, the CPT rule allows the selling party to deliver the goods to the transporting carrier where they wish (a seaport, a railroad terminal, an air cargo terminal, or road transport on their own premises).

Being in charge of the main transport, the selling party is obligated to provide the buying party with the bill of lading if maritime transport is used or the waybill if other modes of transport are hired.

8. CIP (Carriage and Insurance Paid to)

The CIP rule (Carriage and Insurance Paid to) is basically an insurance extension of the CPT Incoterms® rule. All of the obligations and responsibilities for the buying and selling parties remain the same as they were under the CPT rule, except that the CIP rule imposes transport insurance to be obtained by the selling party.

Besides the transport of the goods from their own premises to the destination designated by the buying party, under the CIP rule, the selling party is obliged to arrange transport insurance for the entire journey that their transport contract entails.

This last C Incoterms® rule is applicable to all modes of transport and very convenient for the buyer as they have fewer costs for transporting the goods to their desired destination and they get to enjoy protection made possible by an insurance policy covered by the seller.

The rest of the obligations coming with the use of the CIP rule concerning the transfer of risks, place of delivery, and customs clearances are the same as all the rest of the C rules in this group.

9. DAP (Delivered at Place)

All of the rules in the D Incoterms® are appropriate for the usage of any mode of transport or combination of different kinds of transport (multimodal transport) of the goods subject of sale. They also enforce the highest responsibilities for the selling party in terms of risks and costs for the delivery of goods.

The DAP rule (Delivered at Place) is the first rule in this group that focuses on regulating the delivery of the goods to the point of destination chosen by the buying company. It’s also the first rule that allows the delivery of the goods to take place outside the country of origin.

With the DAP rule, the selling party is also responsible for bearing the risks and costs for transporting the goods through each of the stages of the main transport. In comparison, the rules in the E, F, and C Incoterms® groups allowed for the selling company to deliver the goods and transfer their risks in their country of origin.

The only transport stage that the selling party isn’t required to execute under the DAP rule is the final unloading procedure. This rule allows for the seller to deliver the goods to the final destination point in a perfect state and make them available to the buyer. The latter party can contract the unloading of the goods at the destination port/rail depot/air terminal or do it themselves at their own premises.

10. DPU (Delivered at Place Unloaded)

Including an additional benefit for the buying party, the DPU Incoterms® rule (Delivered at Place Unloaded) extends the obligations of the selling party and requires them to unload the goods after they’ve reached their final destination.

Again, the transport carrier is hired by the seller and they bear all the costs and risks associated with the movement of the goods up to the destination of the delivery which is designated by the buyer.

The DUP rule, like the DAP rule, enables all modes of transport and, therefore, allows for the goods to be delivered far beyond the destination port/terminal. The options for delivery of goods can either be a seaport or another terminal in the destination country, a customs services depot, the buyer’s warehouse or storage center, or delivered straight to door.

As soon as the seller’s hired carrier unloads the goods, the buying party can resume with the rest of the procedures in the logistics chain (import clearances, additional transport, storage, etc.)

11. DDP (Delivered Duty Paid)

The last Incoterms® rule is the DDP (Delivered Duty Paid) rule – arguably, the most convenient rule for the buying party.

This rule bears all the characteristics of the other two D rules – obligating the seller to hire a carriage company that will deliver the goods to the destination designated, cover the costs and risks for the duration of the delivery journey, and ensure the goods are properly delivered to the point of destination.

Additionally, the DDP rule also requires the seller party to cover the costs of both the export and the import customs clearance procedures and every transit procedure if necessary.

Another difference that it has from the DPU rule is that the selling party doesn’t have to contract the carrier to unload the goods at the final destination point, which wasn’t the case with the DAP rule.

Goods sold under the DPU rule can be delivered by any mode of transport including containerized cargo that is moved through freight, rail, or road transport.